The beauty industry is quite broad, including both services and products. Services encompass hairdressers, barbers, and spas. Whereas products cover makeup, skincare, haircare, and perfumes. Growth in this industry bloomed in recent years, with the market size reaching up to 571.1 billion USD worldwide and 2.8 billion USD in Iraq alone.

Traditional distribution channels focus on bricks and mortar supermarkets, pharmacies, and salons. However, e-commerce has become increasingly prominent, with 12.7% of beauty industry revenue in Iraq generated through online sales. The rise of social media propelled the beauty industry forward by creating a visual medium, as well as enabling brands to interact with consumers directly.

We can witness a large number of startups entering the Iraqi market as the beauty industry is one of the best sectors to launch a company. Success factors for those startups include creating a visual identity, focusing on customers and experience, and concentrating on dermatological results and credentials.

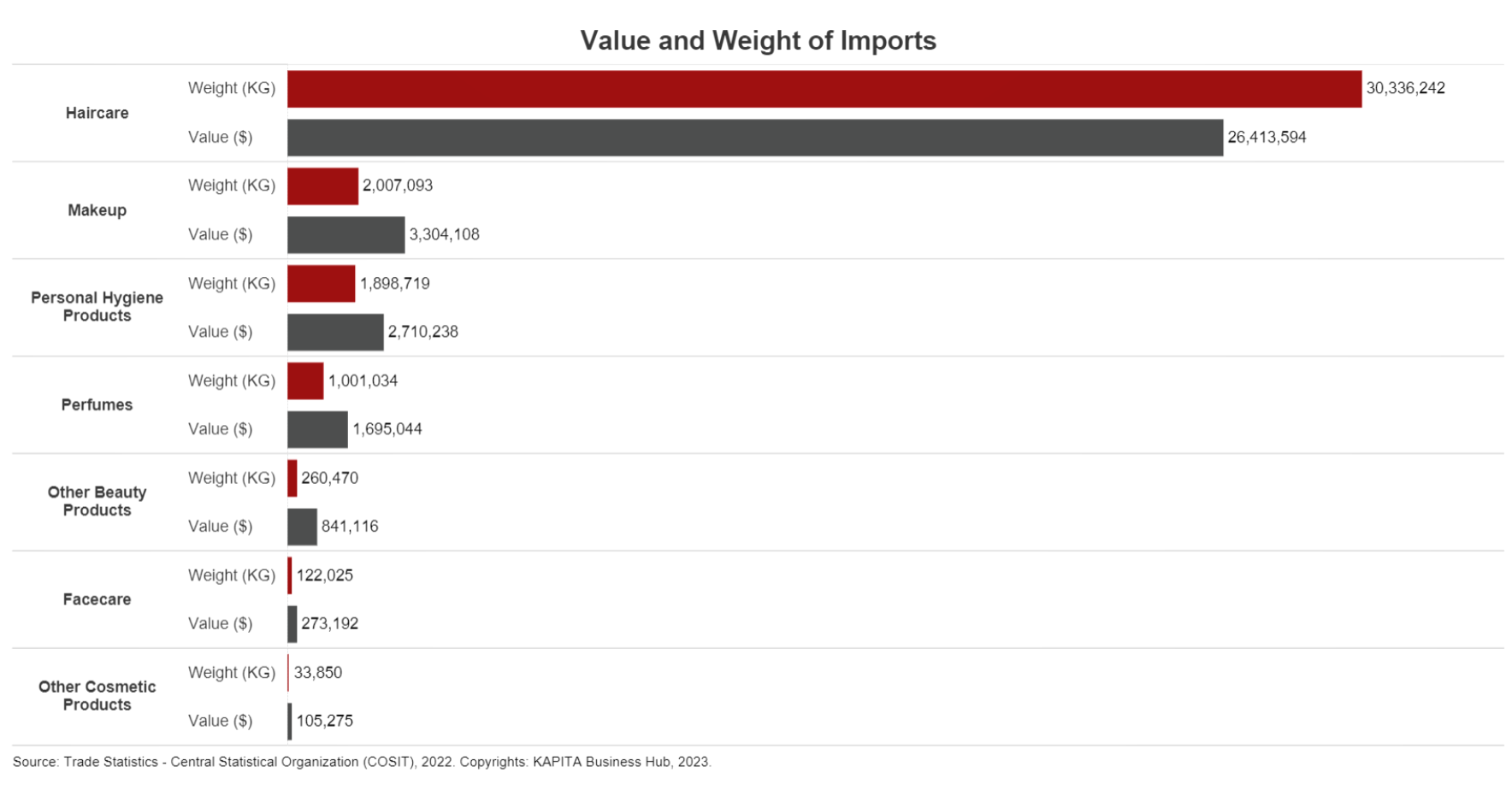

In this report, we provide a comprehensive picture of the cosmetics market in Iraq through the analysis of imports of multiple categories of cosmetic and beauty products according to weight and value and exporting countries. According to data reports of the Central Statistical Organization in 2022, hair care products were the most imported cosmetic products in terms of both value and weight. Imports of hair care products reached a value of 26 million USD, while their weight in kilograms reached 30 million. Imports of the other categories were significantly lower in comparison to hair care products.

This report establishes an in-depth consumer behavior analysis concerning shopping and usage frequency, preferred shopping methods, average monthly spending, brand loyalty, sharing experience with others, and the most essential features of cosmetic products. Insights were mainly driven by a detailed analysis of women who use cosmetic products in Iraq. The primary data were collected through an online survey and focus group discussions.

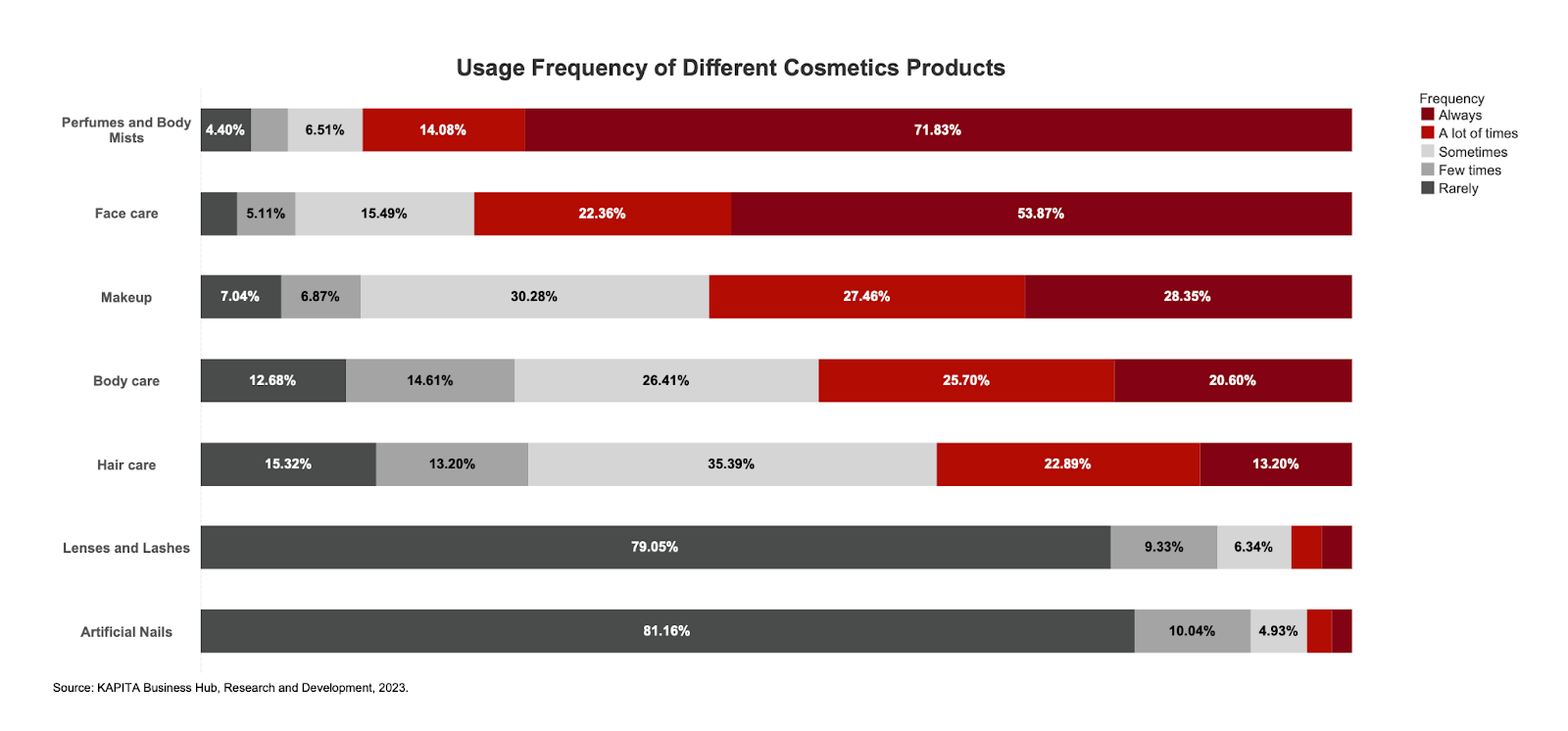

In terms of frequency of use, perfumes and body mists were the leading products, as 70% of our sample stated that they use perfumes and mists on a daily basis. This indicates that perfumes and mists are consistent in the respondents’ everyday routines. Face care products followed a similar pattern.

Lenses and lashes were among the least frequently used compared to the other categories; around 6% use them daily or every other day. The same applies to artificial nails, as the overwhelming majority of the respondents rarely use artificial nails.

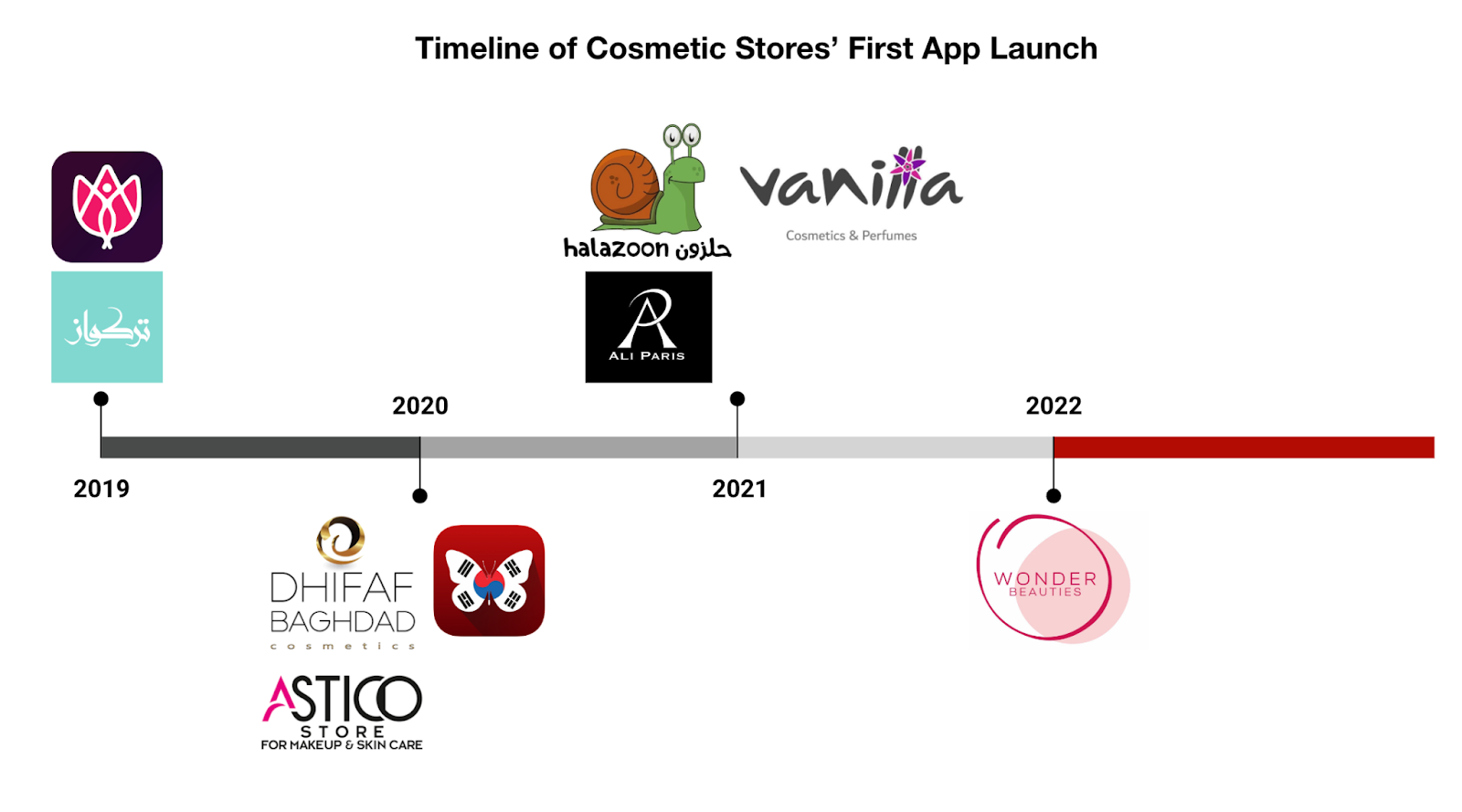

This report also discusses the impact of e-commerce on the beauty market. Most cosmetic companies are switching their approach towards utilizing social media to promote and sell their products, making them the most dominant online sales channels. However, many stores have also started launching their own websites and mobile applications for a seamless shopping experience or selling their products through other Iraqi e-commerce platforms to keep up with the shift in consumer behavior.